Lessons from Jim Edwards at Maestria Partners

Insights from an Allocator's Journey to Quality Oriented Portfolio Manager

Every once in a while, I come across an interview I have to listen to several times. Ben Claremon's conversation with Jim Edwards is one of them. The episode is a goldmine of insights despite only having 3 likes on Twitter and 689 views on YouTube.

Jim's perspective is interesting because he spent years as an allocator for large endowments before launching his fund. His experience as an allocator helped him understand what works and why so many managers fail.

His firm, Maestria Partners, which means "mastery," is built on those lessons. Here are the key ideas I took away.

1. Peter Kaufman’s Four Levels of Learning

One mental model from the interview I keep returning to is Jim's application of Peter Kaufman's four levels of learning. From his seat as an allocator, Jim saw how these levels separate investors.

Peter Kaufman has four tiers of learning […] the best investors in the world really get to level three or four.

Level one: You continue making the same mistakes, you don't ever learn, and you keep running into the same dead end.

Level two: You learn from your own mistakes, don't repeat them, and you figure out a path very slowly.

Level three: You learn from the mistakes of others and don't repeat them.

Level four: You keep making right turns; you learn from the mistakes of others, and you emulate their successes.

Most of us get stuck at Level 2, learning only after we lose money. The goal is to climb to Levels 3 and 4.

Level 3: Study Failure (For Free)

Learning from the mistakes of others is a free education.

Seek out books, articles, and investor letters that explain why a business failed or a stock collapsed.

Learn about past bubbles to recognize the patterns of herd behavior and euphoria when they appear again.

Pay attention to today’s fads and speculative manias. Jim mentioned avoiding things like "the venture fluff we saw a few years ago, or the cannabis or commodities stuff" as examples of promotional areas where mistakes are common.

Find interviews where managers talk about their biggest mistakes.

Level 4: Build Your System

The final step of learning is about being proactive. You are not only avoiding mistakes but building a process around what works.

When studying successful investors, break down their philosophy into the core principles that you can apply.

Create a simple, written process for making investment decisions based on the habits of great investors.

Define what you won't do. A key part of copying success is knowing your limits. Create a "too hard" pile and be disciplined about staying within your circle of competence.

2. Simplicity, Focus, and Alignment

Jim's focus on simplicity, focus, and alignment was the result of studying other managers.

Being really focused and disciplined, as well as maintaining alignment—those three simple terms of simplicity, focus, and alignment—I think a lot of people don't appreciate... Going slow with aligned partners, staying small, and being focused on the investing piece is the most important thing.

Simplicity: The Power of Less

The investment industry sells complexity. Jim attempts to remove everything that isn't essential to the core task of investing.

Own a portfolio of great businesses. No shorting, no leverage, no market timing.

Avoid bureaucracy and stay focused on research, not managing a large organization.

Low turnover. Most of the time, the best action is no action. Jim noted his fund had only seen trading activity on eight days since its inception.

Focus: The Need for Concentration

To outperform the market, a portfolio must look different from the market.

Own 10-15 stocks. A concentrated portfolio ensures that every holding is meaningful and thoroughly understood.

Go miles deep on a few businesses rather than an inch deep on many.

Spend time learning about businesses, not guessing the direction of the economy or the market.

Only invest in companies and industries you can understand.

Alignment: A True Partnership

Jim cited how high fees, and poor transparency created a huge gap between a manager's success and their clients' results.

The goal is for his partners to keep 90% or more of the gross returns, in contrast with typical hedge funds which can siphon off over 30%.

Partners get full transparency. They know what they own, why they own it, and in what proportion, with monthly liquidity.

Jim’s capital is in the fund on the same terms.

The ultimate measure of success isn't just the fund's time-weighted return. It helps partners achieve good dollar-weighted returns by encouraging them to invest more during downturns and being cautious after strong runs.

3. There Is No Substitute for Quality

With a focused portfolio, every single business has to earn its place. This discipline comes from the mistake of investing in low-quality companies.

The biggest mistake I ever made was a mining company... You just learn that there is no substitute for quality cash flows and high-integrity people. Putting all of those other things—commodities, low-quality businesses, promotional management teams where it seems too good to be true—in the 'too hard' bucket was the most important learning for me.

This single mistake became a filter for his investment process. By swearing off entire categories of businesses, he can focus on the best companies.

What Quality Looks Like

For Jim, high-quality businesses share a few key traits.

They have a deep, competitive moat. Jim uses Hamilton Helmer's "Seven Powers" framework to analyze these advantages.

They are run by management teams you can trust to build value for the long term.

They are profitable businesses that produce lots of cash.

They operate in large markets with plenty of room to grow and reinvest their profits at high rates of return.

Why Mega Caps Can Still Be Bargains

This focus on quality naturally leads him to some of the world's largest companies. Jim believes investors are making a mistake when they dismiss them as too obvious.

Today, hyperscale data centers cost billions and require immense amounts of power. This capital spending creates a barrier that is nearly impossible for competitors to overcome. As Jim puts it, the "battle's already been won" at the infrastructure layer for cloud and AI.

Many large companies have valuable divisions that the market underappreciates. Jim notes that a company like Google has latent, underappreciated assets, such as YouTube or its Cloud business, whose full value isn't reflected in the stock price.

He believes we are still in the early innings of the global shift to cloud computing and AI. The biggest players have a long way to go.

The biggest error investors have made with these businesses over the last decade was selling them too soon.

4. A Look at the Portfolio

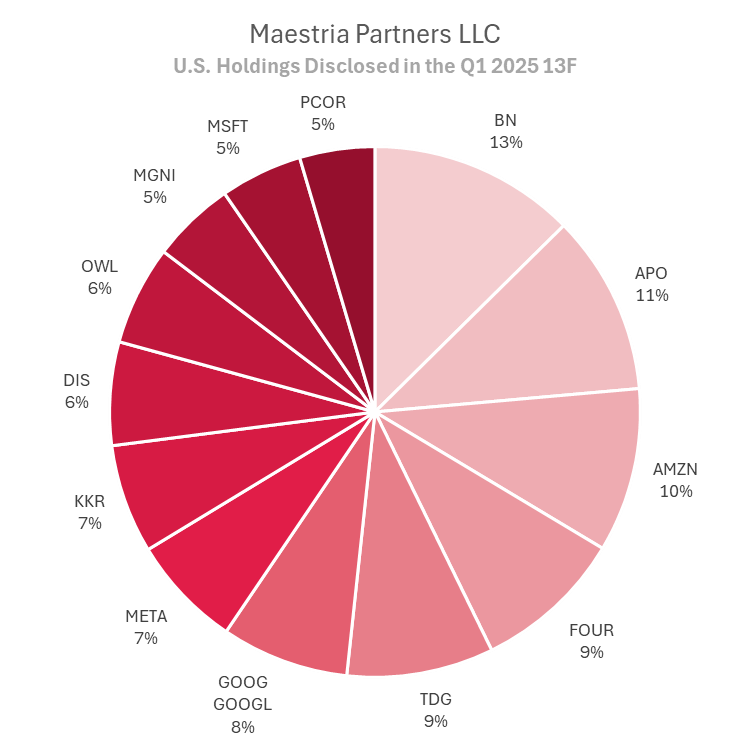

A look at Maestria's holdings shows the philosophy in practice. The portfolio is highly concentrated, with over half the fund in its top five names: Brookfield, Apollo, Amazon, Shift4, and TransDigm.

This demonstrates a deep conviction in each company. The quality theme is clear, with large positions in hyperscale tech companies (Amazon, Alphabet, Microsoft) and top-tier asset managers (Brookfield, Apollo, KKR).

Keep in mind, this list only shows his U.S. holdings from quarterly 13F filings. So, any international stocks, like a potential position in Constellation Software, won't show up here.